Geely’s commercial vehicle manufacturer Farizon will launch the Farizon SV van, which has been designed to be electric from the ground up for the European, Gulf and Asia-Pacific markets, in 2025.

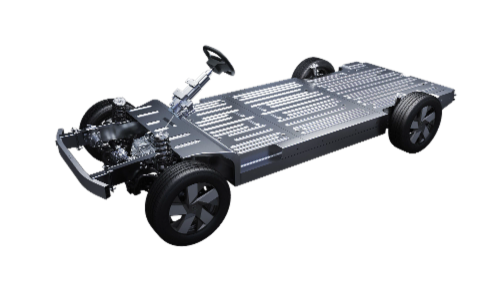

The Farizon SV is built on the new GXA-M platform, which is designed for an electric van without the combustion engine tradition. The steering and brakes are powered by a drive-by-wire system with double redundancy – the first of its kind in a series production van, according to the manufacturer. The model has already received a five-star rating from Euro NCAP.

-

That’s a remarkable amount of work hours for a single machine, the Norcar 600 owned by Erkki Rinne is taken well care of, it even has the original Diesel engine.

-

Kieran Anders is a forestry contractor working in the lake district. His work involves hand cutting and extracting timber using a skidder and tractor-trailer forwarder.

-

It is not possible to eliminate chain shot, but there are simple steps that can be taken to reduce the risk.

-

Arwel takes great pride in the fact that the mill has no waste whatsoever, “the peelings are used for children’s playgrounds, gardens and for farm animals in barns in the winter and the sawdust has multiple uses in gardens and farms as well.

-

Timber hauliers need to encourage young blood in, and also look after the hauliers we have, we need make the sector a safe and positive place to work.

FIND US ON

Related Posts

Geely subsidiary Farizon is pitching high equipment levels on its full-electric vans — including standard adaptive cruise control and heated seats — to European customers as it looks to overcome resistance to both battery-driven powertrains and newcomers in the conservative light commercial van market.

The Chinese company has begun taking orders for its SV midsize van in the U.K. following market launches in Spain, Portugal, Serbia, Greece, the Czech Republic, Austria and Slovakia.

Farizon aims to lure buyers away from Ford, Renault and Stellantis in the burgeoning electric van space as legislative pressure mounts to sell more EVs in a market reluctant to shift from diesels.

Farizon aims “short-term to be top five and long-term top three” in among sellers of midsize electric vans, U.K. head Tom Carney told Automotive News Europe at the launch here on Feb. 24.

The Farizon SV’s U.K. starting price is £45,000 ($57,000), excluding value added tax, for the entry version with a 67-kilowatt-hour battery pack, pitching it directly at the full-electric Ford Transit Custom, which starts at £44,899 and has a 65-kWh pack.

However, to stand out the entry SV includes equipment such as heated seats, a heated steering wheel and keyless entry – all of which cost extra on the base version of the Transit Custom.

Farizon also offers the entry SV standard with a range of driver-assistance features including adaptive cruise control, as well as comfort features such as rain-sensing wipers, cooled seats and surround-view cameras. Also included on the SV is a payload monitoring system that gives a readout and alerts the driver if the van is overweight.

“We are competitive on price, but when you have a look at the competitors’ equipment a lot isn’t standard or isn’t even available,” Carney said.

Another feature that Farizon is keen to emphasize is that the van has been designed from ground up as an EV, rather than being adapted from a combustion engine platform as Ford, Stellantis and Renault have done so far. Farizon says this results in more load space and allows for innovations such as removing the B-pillar and providing a wider side-opening door.

Farizon hopes the selling points will convince customers loyal to the established van makers to give a chance to a newcomer selling a drivetrain that remains unpopular.

Electric van sales in the European Union fell 9.1 percent to 130,523, accounting for just 6.1 percent of the market, according to industry association ACEA.

U.K. electric van sales were slightly higher in the first month this year, up 13 percent to 1,340, resulting in a 7.0 percent market share, according to the country’s automotive group, the SMMT.

Electric van sales must improve in the EU and U.K. or automakers could face fines. That pressure, however, has been relieved by proposed changes to the regulation that will allow van makers to meet their compliance targets by averaging their performance over a three-year period until the end of 2027.

In the U.K., van makers must raise their EV share to 16 percent of their total, up from 6.3 percent, to comply.

Van makers are helped by the continuation of sale incentives for electric vans in the U.K., but Farizon also has to convince fleet managers to shift away from their established brands.

“There is a saying that no fleet manager ever lost their job buying Ford Transits’,” Andy Carroll, special advisor with Farizon importer Jameel Motors, told Automotive News Europe.

The company is working through all the potential issues fleet managers could have, right down to working with insurers to make sure the vehicle appears in dropdown menus on their website.

“There are any number of pitfalls. You are only as strong as your weakest link,” Carroll said.

The biggest fear of the fleet manager is that the vans will be out of service for long periods after a problem, putting Farizon under scrutiny during the early stage when fleets take a single van to test.

“They almost want to have a problem, so they can see how you react,” Carroll said. “If one of their drivers does bump into something in central London, they want to know how quickly the van will be back on the road.”

Chinese electric van makers are not subject to the same tariffs imposed on China-built electric cars, but so far only SAIC’s Maxus subsidiary and Dongfeng’s DFSK have joined Farizon in the sector, with Skywell promising an entry this year.

Farizon’s entry is the most comprehensive among the Chinese players so far, with the SV (short for Supervan) designed specifically for the region’s large van segment, midsize. The SV is offered with a choice of three lengths, three heights and with three different battery configurations.

Customers are mainly reassured by the country of origin due to China’s wholesale embrace of EVs, Carney claimed. The two entry lithium-iron phosphate (LFP) battery packs and larger 103-kWh nickel manganese cobalt (NMC) are sourced from China’s largest battery maker CATL.

Target customers are mainly bigger fleets, either offering so-called last-mile delivery in urban areas, or acting as service vehicles. Bigger companies are more likely to embrace the electric vans as part of their sustainability efforts. Those are the companies that Farizon is targeting first. The rest of the van market will be more challenging for the Chinese company, Carrol said.

Sign up for our free monthly newsletter here

Contact forestmachinemagazine@mail.com to get your products and services seen on the world’s largest professional forestry online news network.

#homeoflogging #writtenbyloggersforloggers #loggingallovertheworld

Written by loggers for loggers and dedicated solely to the equipment used in forestry operations.